Don’t Let Myths Keep You From Protection

When it comes to life insurance, myths are everywhere. And unfortunately, believing them can stop families from getting the protection they need. Let’s clear the air and replace fear with truth.

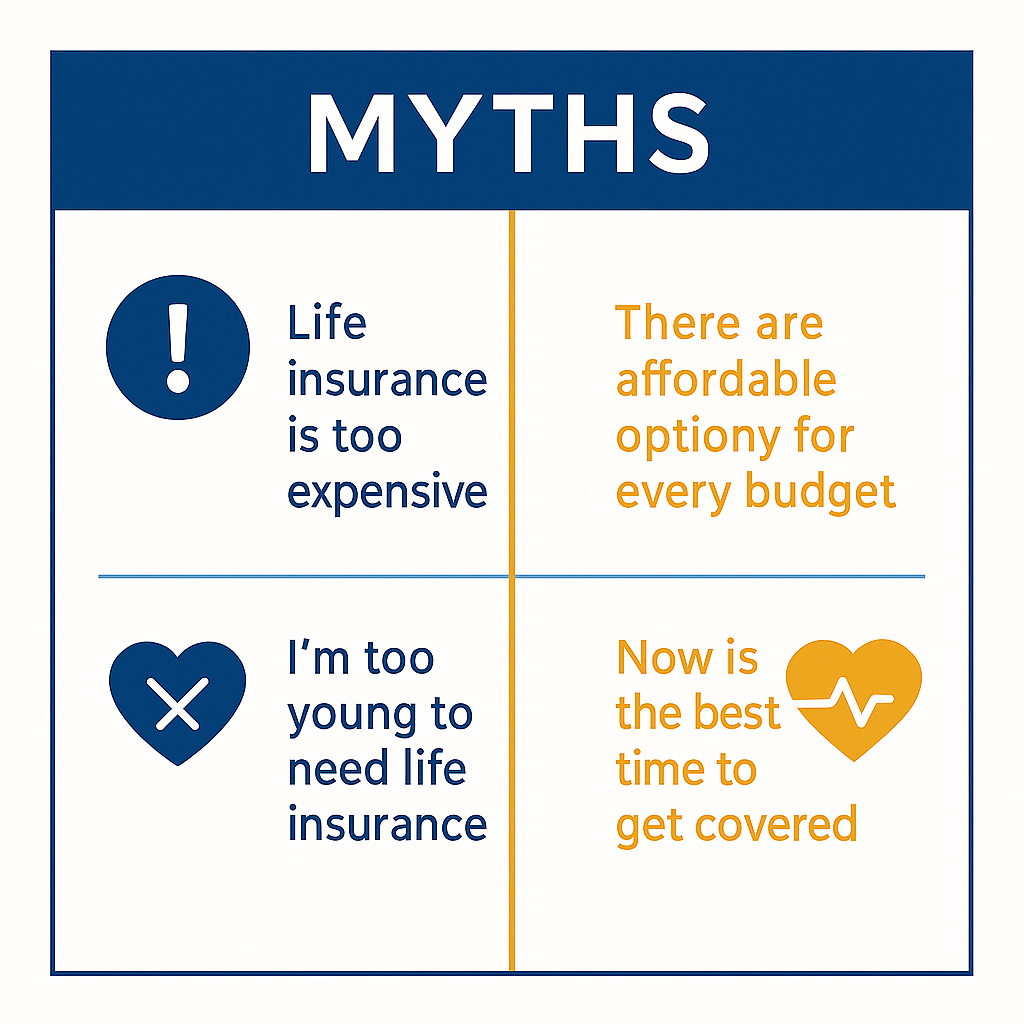

Myth #1: “It’s Too Expensive”

Reality: Most people overestimate the cost by 3–5 times. Many plans start at less than $1 a day — cheaper than your morning coffee.

Myth #2: “I Don’t Need It If I’m Young”

Reality: The younger and healthier you are, the lower your premiums. Waiting only makes it more expensive later.

Myth #3: “Work Insurance Is Enough”

Reality: Employer coverage usually disappears when you leave your job. Plus, it’s often only 1–2x your salary, far less than your family would need.

Myth #4: “It Only Benefits My Family After I Die”

Reality: Some policies come with living benefits — meaning you can use funds if you face a major illness while still alive.

A Young Father’s Wake-Up Call

I once met a young father who hesitated because he thought his work insurance was “enough.” When he changed jobs a year later, his coverage vanished overnight. Imagine if something had happened in that gap — his family would have been unprotected. That’s why myths can be dangerous.

The Bottom Line: Truth Brings Peace of Mind

The truth is simple: life insurance isn’t as scary, complicated, or costly as people think. Once you separate fact from fiction, protecting your loved ones becomes a lot easier.

👉 Want to know the real cost for you? Check your quotes instantly here.